Opportunities for Money Support & Risk Tooling

Service Design Project

IMPORTANT NOTE: When I was laid off, I lost access to everything immediately. I do not have the original files to format into a portfolio project. If you only watch one thing, chose the teaser video — it will give you a good idea of how this project looked.

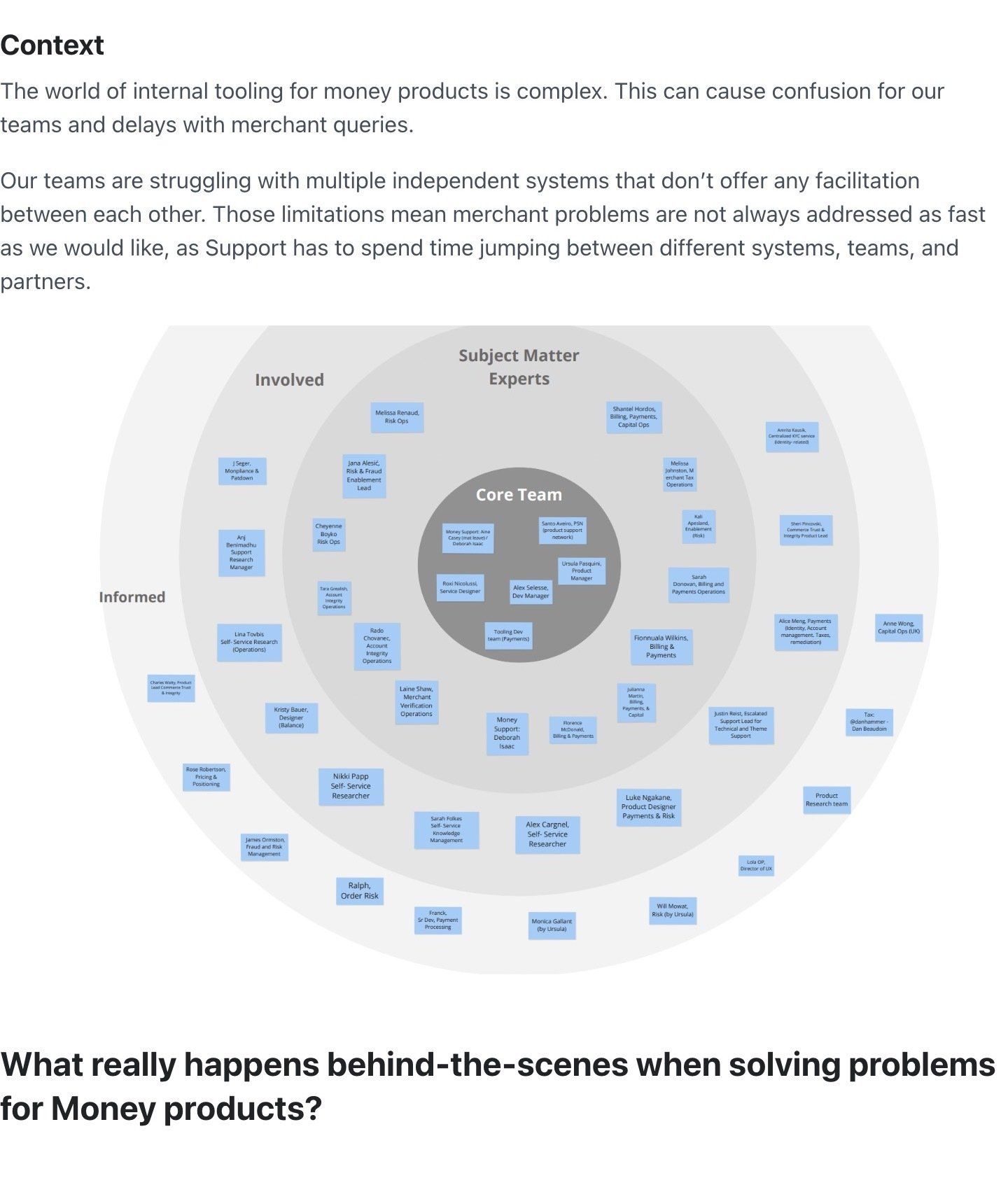

- stakeholder/ user interviews (product, tool users)

- secondary research (for example; data on call resolution)

- tool shadowing

- call listening/ chat analysis

- journey mapping

- workshop facilitation to identify pain points and opportunities

- synthesis

- strategy pitches to executive leadership

- implementation partnering with design, product, and engineering

The vision

Empowering Shopifolk to do more by making more information visible and more actions possible from a single dashboard. We will consolidate the interface across money, optimize for internal team capabilities, and increase self-serve opportunities.

Consolidation and integration of money tooling

Our first use cases:

1. Better integrations with risk tooling

- KYC updates

- Installments integration with Activity log

- Business events for Money

2. Improved Categorisation / Profiling of Actions by usage or team

- Triaging

- Per-team/ customizable dashboard

- Giving more actions to front-line support

3. Empowering merchants through more self-service and transparency of information (influence)

4. Tracking usage of tools

The Impact

Although the strategy is being implemented in phases, as of July 2022 we were able to create seamless integrations with:

- risk tooling,

- tax-related updates

- Installments, and

- a log of detailed business events

... while removing one payments processor and scaling an other to a new country.

Thanks to the improved understanding of different team workflows, it has become possible to:

- Improve triaging

- Create per-team/ customizable dashboard

- Give more actions to front-line support, reducing escalations

- Start collecting usage data to improve future workflows

A new group (of three teams) was created to focus on implementing this tooling strategy to retire, consolidate, and embed 14 workflows into three.